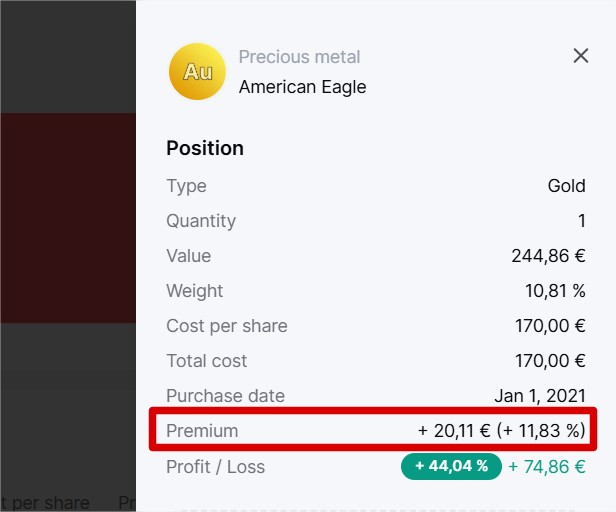

When you add your precious metal investments to Invvest, we display a very useful piece of data in the insights for your tracking: the premium.

When you buy a gold or silver coin, you are not only paying for the price of the metal but also for its condition, rarity, the seller's commission, etc. Two coins can have the same quantity and purity of gold but be sold at different prices.

There is therefore a difference between the net value of the metal and the purchase price. This difference is called the premium. You can think of it as a kind of valuation indicator for a purchase.

The higher the premium, the more overvalued your metal purchase is. The lower the premium, the closer you are to buying your metal at its fair value.

To calculate the premium of a coin you own, for example, we need the purchase price and the purchase date to find the gold price on that date.

For example, you bought a pure gold coin weighing 1 gram on January 1, 2021, for €53. On January 1, 2021, the price of gold per gram was €50. You therefore paid a premium of €3 (or +5.7%).

In practical terms, the premium helps to better understand whether a piece or a bar was purchased well or poorly. It’s a kind of performance indicator for purchases.

Many "novice" buyers are surprised and don’t take the premium into account until they realize it will take too many years to become profitable.

It is therefore important for a metals buyer to visualize their premiums to optimize future purchases.

For reference, a good purchase for gold = premium between 3% to 5%, and for silver = premium between 20% and 25%.