Your capital profit/loss is at the heart of tracking your assets and investment portfolios. We use it in many places to provide you with a detailed analysis of your performance.

The unrealized profit/loss is the difference between the current value of an investment and your invested amount.

For example, you bought an Apple stock at €150 in July 2022, and it is worth €250 today. Your unrealized gain/loss would be +€100.

To function properly, we need your average purchase price for each position. You can add them manually or retrieve them automatically via synchronization.

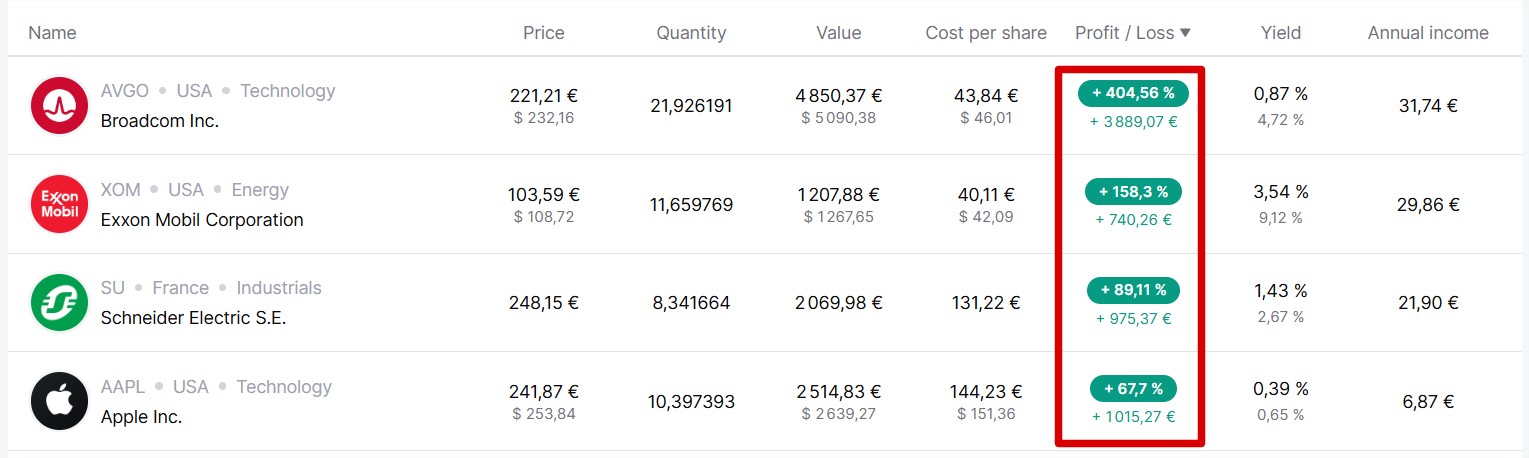

We display your profit/loss at the level of each position, both in percentage and in value.

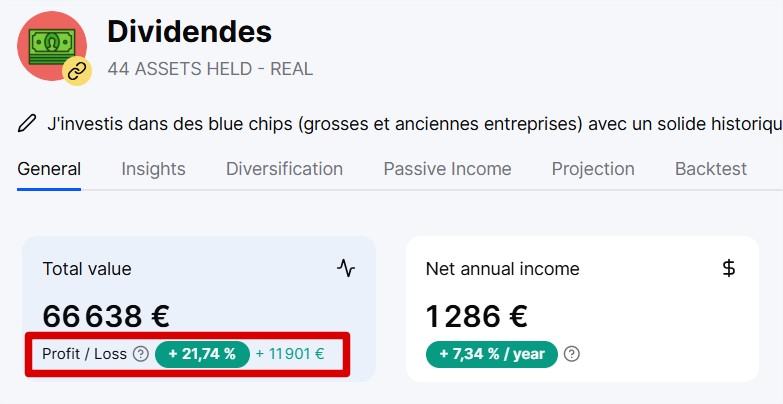

Also at the global level of the portfolio and dashboard.

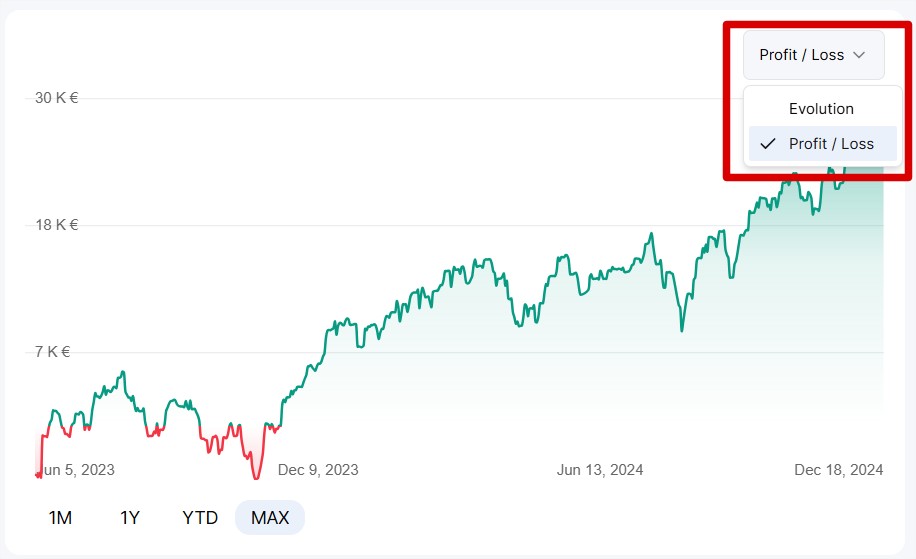

We record your unrealized profit/loss daily to present you with a history of its evolution over time.

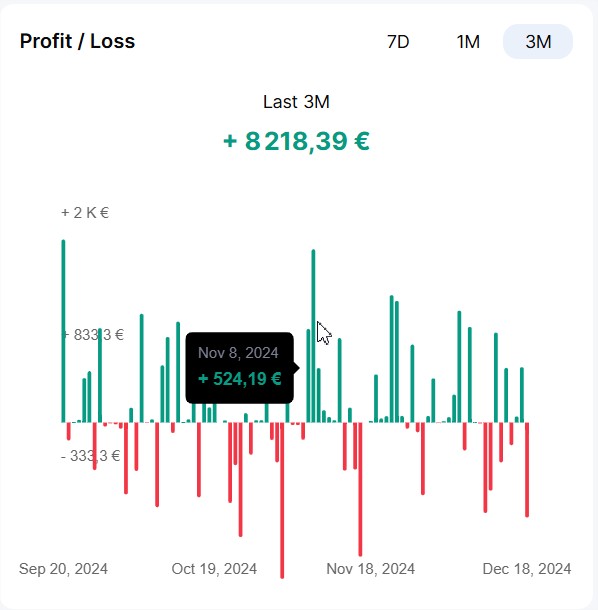

Thanks to this daily recording, we can also show you day-to-day variations over a period of up to 3 months on your dashboard.

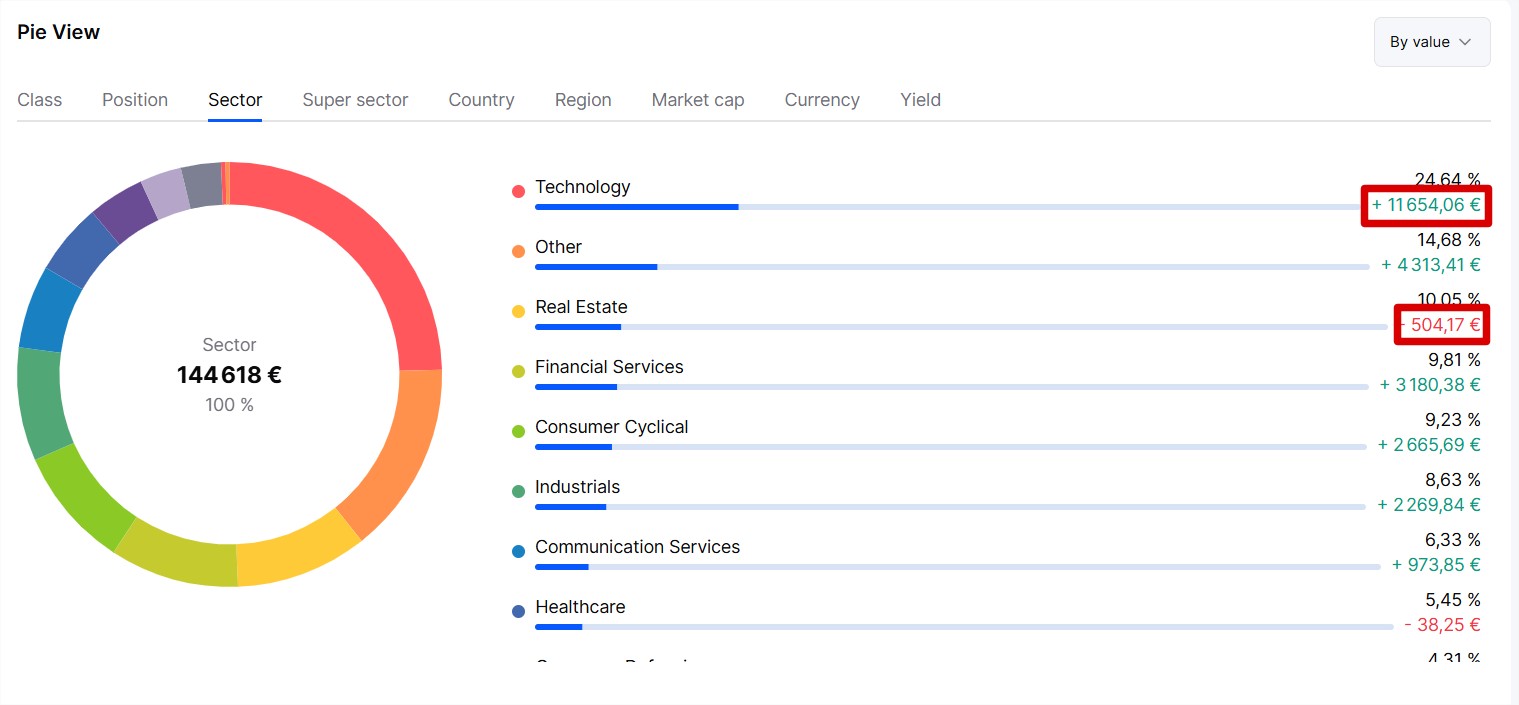

And finally, we use your profit/loss in the display of your allocations in the “Diversification” section of your dashboard and portfolios. This helps you better understand where your gains and/or losses come from.

Have you sold an investment with a profit? This results in a realized capital gain. This type of capital gain is currently not taken into account on Invvest due to the complexity of tracking.

The capital gain displayed on your account is always the unrealized capital gain. Therefore, there may be differences between what your broker displays and Invvest.