Flagship products of the Invvest platform, Stock Scores allow you to quickly assess whether a stock is interesting or not based on various criteria.

On a stock’s page, in the “Scores” section.

We have created 6 scores to evaluate a company from all angles. These scores are proprietary and based on our own analysis algorithms, which take into account dozens of fundamental and technical criteria.

The goal is to help you analyze a company more effectively and quickly. Our 6 scores are:

Dividend Safety Score

Growth Potential Score

Financial Strength Score

Profitability Score

Momentum Score

ESG Score

For each score, we display:

the current score

the score history to see its evolution over time

the details of the indicators used to calculate it and, for each, its rating

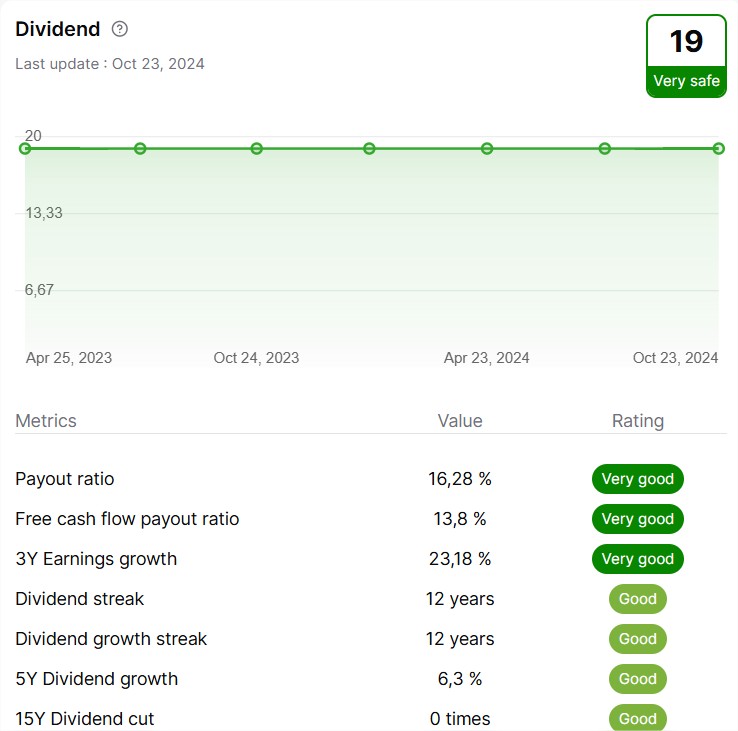

The dividend safety score is an indicator that evaluates the reliability and stability of a dividend paid by a company. It ranges from 1 to 19, with 19 indicating a very safe dividend, unlikely to be reduced or suspended.

A high score reflects a financially strong company capable of maintaining its dividend payments even during economic difficulties, while a low score may signal an increased risk of dividend reduction or suspension.

About fifteen indicators are used to calculate it, including the payout ratio, earnings growth, the number of dividend interruptions, and the interest coverage ratio.

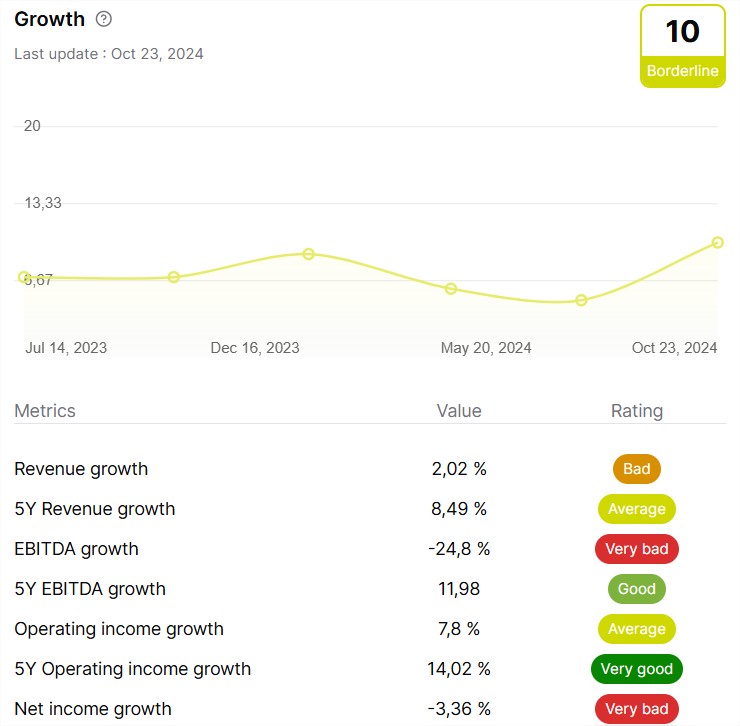

The growth score evaluates a company's ability to increase its revenue, profits, and cash flows over time.

A high score indicates that the company is experiencing strong expansion and has good prospects for future growth, while a low score may signal stagnant or declining growth.

About fifteen indicators are used to calculate it, including revenue growth, profit growth, and capital expenditure growth.

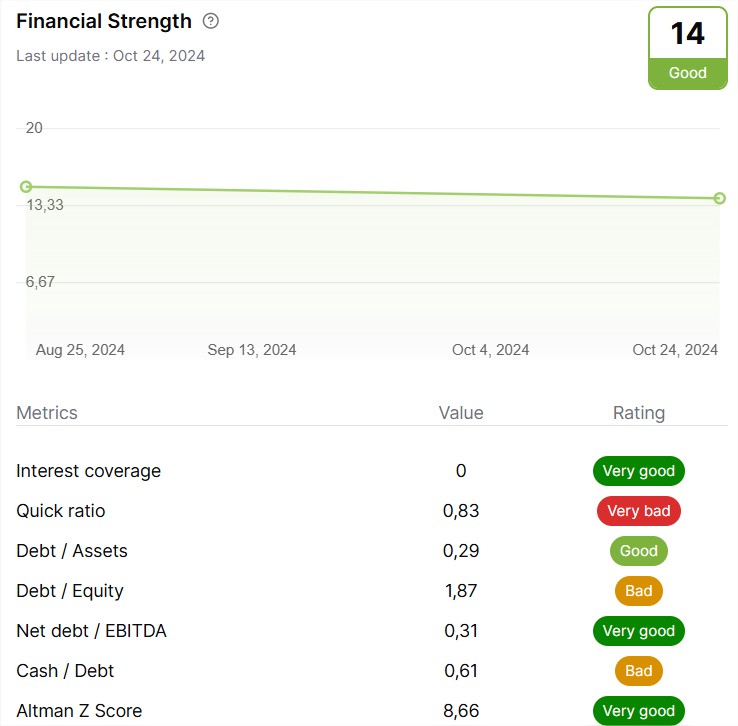

The Financial Health Score is a simple and effective indicator, ranging from 0 to 19, to assess a company's financial strength.

Based on key criteria such as the interest coverage ratio, quick ratio, net debt to EBITDA, as well as the Altman Z and Piotroski scores, it synthesizes a company's overall financial condition. A score of 19 reflects excellent financial health, while a score of 0 indicates severe difficulties.

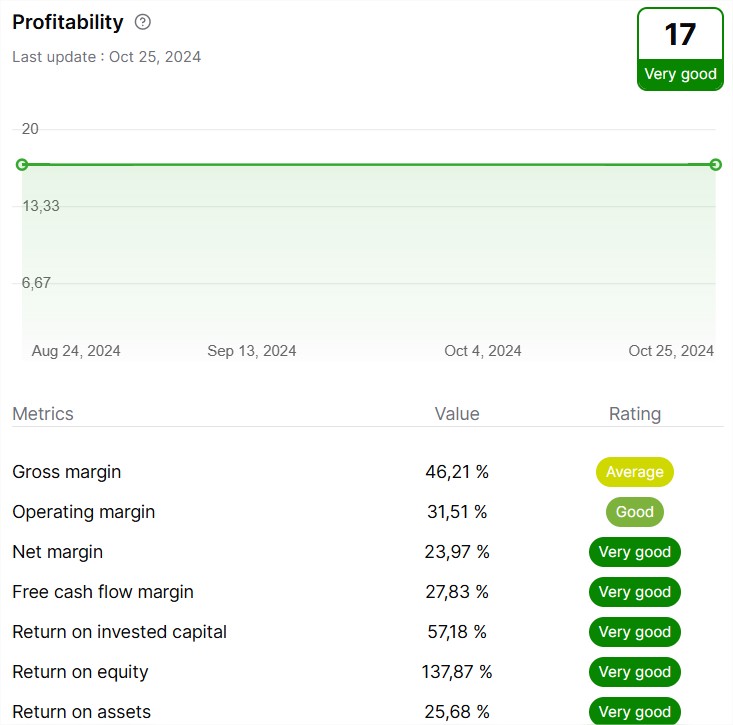

The profitability score evaluates a company's ability to generate profits from its operations. It is calculated using several financial indicators such as return on assets (ROA), return on equity (ROE), and net profit margin.

A high score indicates that the company is very profitable and efficient in generating profits, while a low score signals low margins or difficulties in achieving profitability.

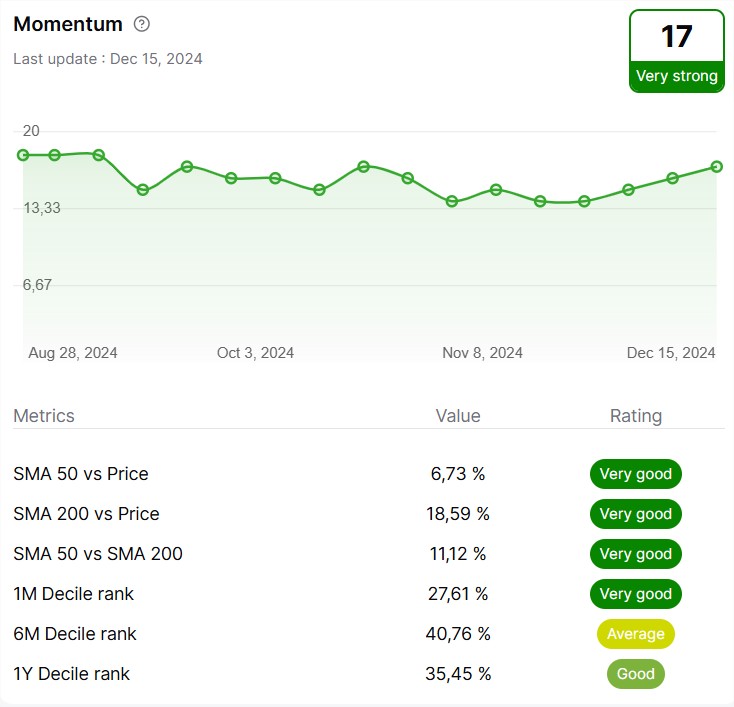

The momentum score measures the dynamics of a stock, based on its recent price movement and performance relative to the market. It evaluates whether the stock price tends to rise or fall rapidly over a given period.

A high score indicates that the stock is experiencing strong upward momentum, while a low score signals downward momentum or stagnation.

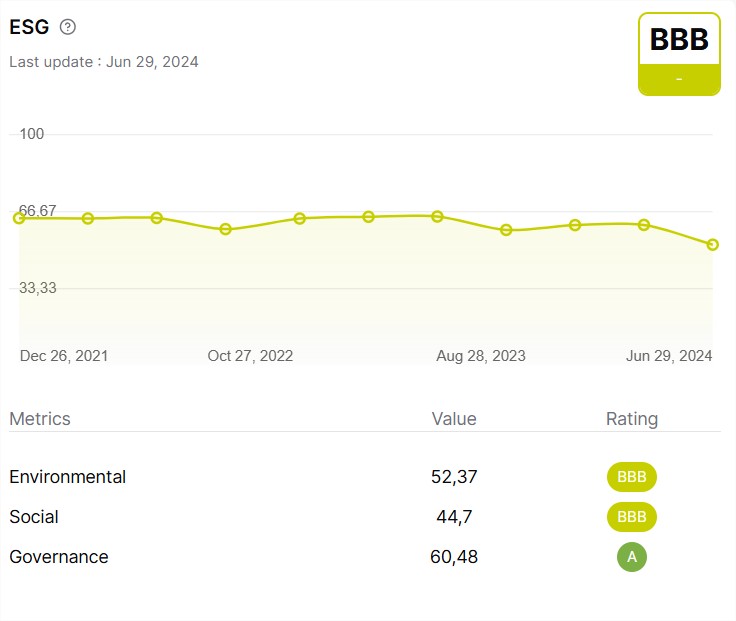

The ESG score evaluates a company's performance in terms of environmental, social, and governance practices. This score is based on criteria such as managing environmental impact, relationships with employees and communities, and the quality of corporate governance.

A high score indicates that the company adopts responsible and sustainable practices, while a low score may signal shortcomings in these areas.