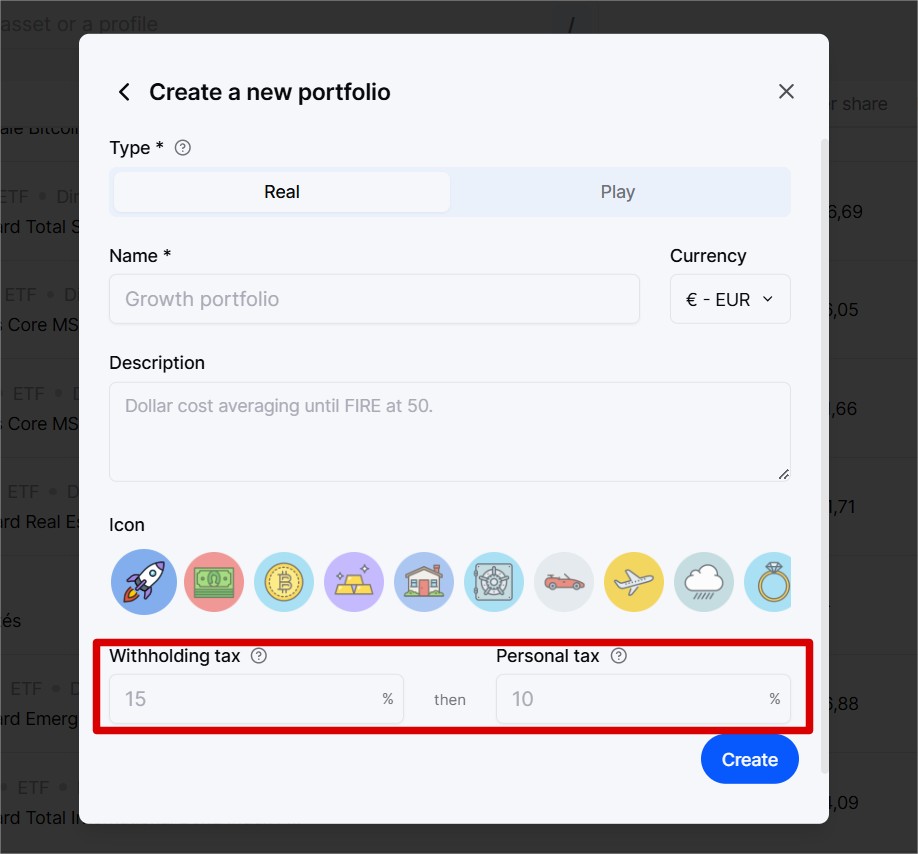

When you create a portfolio (synchronized or manual), you have the option to define its taxation (withholding tax and/or tax rate).

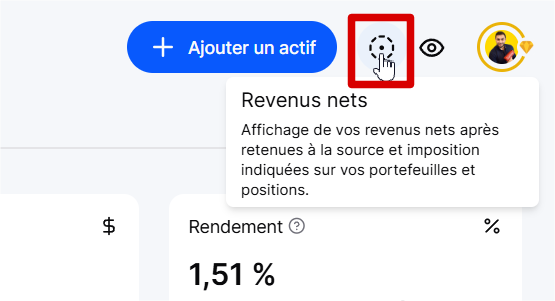

This taxation will allow you to see your passive income from the portfolio in gross and net amounts across the platform, thanks to the dedicated icon in the top section.

If you do not set any taxation, your gross and net income will be the same.

If you set a 30% tax rate, for example, on a portfolio that generates €1,000 per year in income, you will see an annual income of €1,000 in “Gross” mode and €700 in “Net” mode.

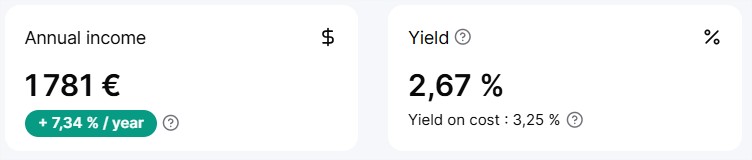

Example in Gross mode…

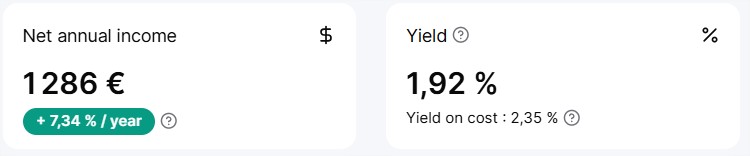

In Net mode…

You will note that this taxation also allows you to calculate your net return.

When you specify taxation at the portfolio level, it will by default apply to all the assets within the portfolio.

However, it is possible that an asset has its own specific taxation. No problem managing this scenario on Invvest.

Scroll down in the portfolio to the asset for which you want to apply customized taxation.

Click on the three small dots then “Edit” in the menu that appears.

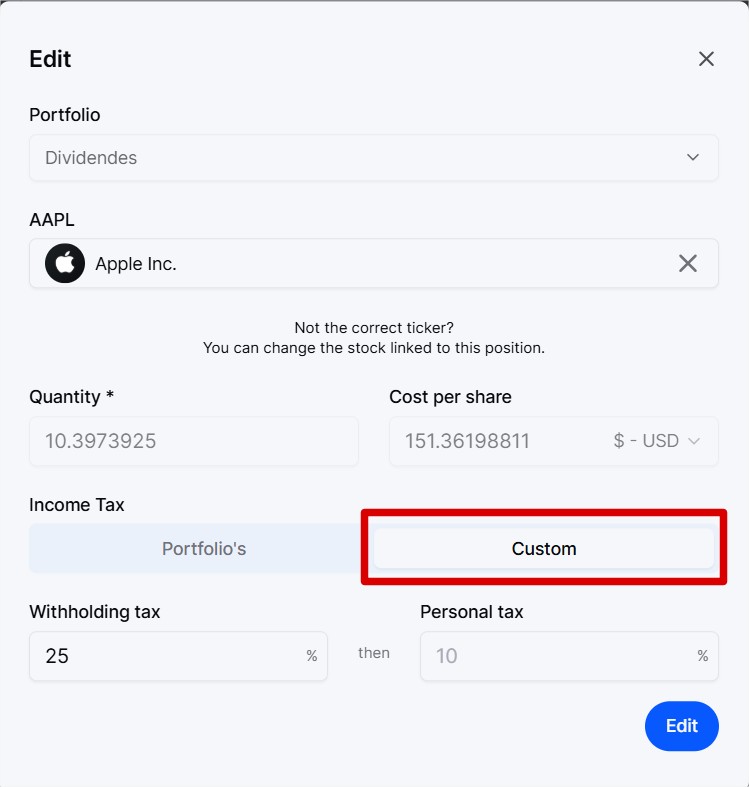

By default, the taxation of the asset will be that of the portfolio. Click on “Custom” then fill in the taxation that will apply only to this asset.

Then “Edit” to validate the changes.

As you may have noticed, this feature includes two fields to fill in: withholding tax and personal tax rate. These two fields are optional. You can fill in both, just one, or none depending on your situation.

These two fields are cumulative. This means that the withholding tax is applied first, and then the final net amount is calculated from the result using the personal tax rate.

To better understand, let’s imagine that your gross annual income is €1,000.

If you set 25% for withholding tax and 10% for the personal tax rate, it’s not 1000 - 35% = €650.

The calculation will be:

1,000 - 25% = €750

Then 750 - 10% = €675.