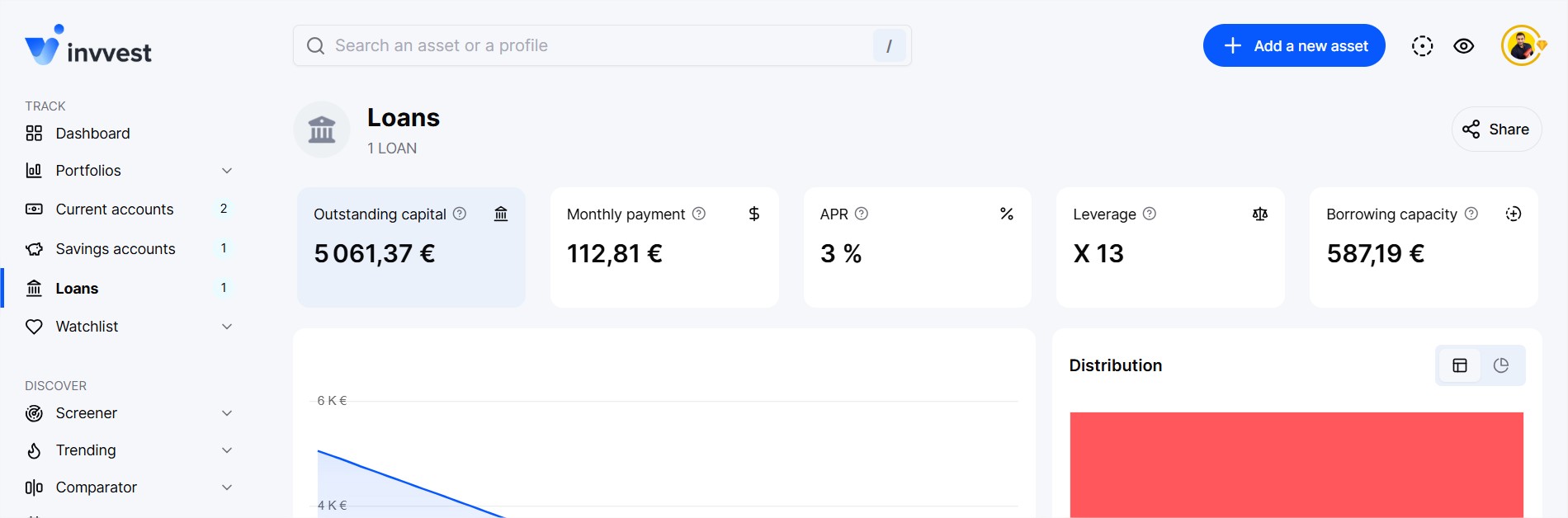

When you go to the "Loans" section of your Invvest account, you benefit from 5 views, including:

Leverage

Borrowing capacity

Leverage is the ratio between the total amount borrowed and your down payments (if specified when adding your loans).

The formula is simple:

Leverage = Total borrowed / Down paymentsFor example, if you borrowed a total of €100,000 with a down payment of €10,000, your leverage will be x10.

If you made no down payment, your leverage will be x0.

Borrowing capacity represents the amount of additional monthly payments you could potentially afford before reaching the maximum allowed debt ratio of 35%.

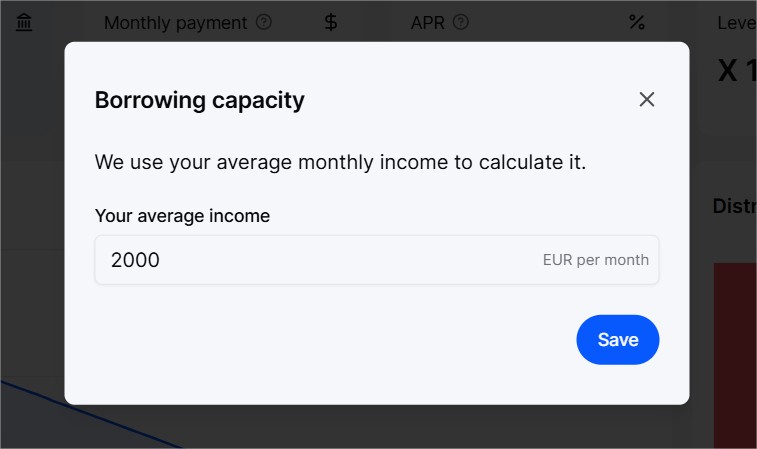

To calculate it, we need to know the amount of your monthly income, which you can indicate by clicking on the "Borrowing capacity" view.

Let's imagine your income is €2,000 per month. The maximum debt-to-income ratio generally required by banks is 35%. This means your monthly payments should not exceed 35% of your income. In this case, that's €700 (€2,000 x 35%).

If you add a loan on Invvest with a monthly payment of €250, your available capacity will then be €450 (€700 - €250). You can therefore still borrow for additional monthly payments of up to €450.