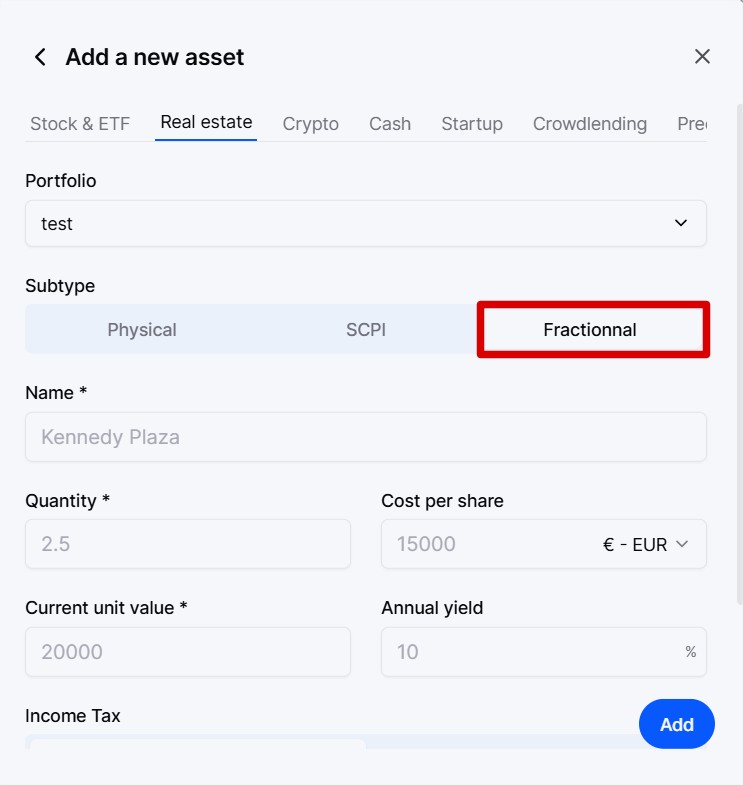

When you add a real estate asset on Invvest, you have the choice between three subclasses:

Physical

SCPI

Fractional

The first two are quite easy to understand as they are well-known. The “Fractional” subclass corresponds to the new way of investing in real estate that emerged starting in 2020 and allows multiple investors to jointly purchase one or more properties.

The property is divided into small shares that investors can acquire with very low entry tickets (starting from €10 on certain platforms). The potential gains (rents and resale capital gains) are shared among the investors, proportionally to the number of shares each one holds.

This type of investment is offered by specialized platforms such as Bricks, Tantiem, or Streal.

Given the rapid success of fractional real estate investment, we have added a dedicated addition mode on Invvest that takes its specificities into account.

However, be careful not to confuse it with another type of real estate investment, which is crowdfunding.

In this case, the investor does not acquire any rights to a property but simply lends money to a project owner who repays the capital and interest. The profits related to the property (capital gains and rent) go 100% to the project owner.

This is, for example, the case with the new bond investment model proposed by the Bricks platform, which has gradually abandoned the fractional royalties model.

This type of asset should be added in the “Crowdlending” section on Invvest, and in fractional real estate.